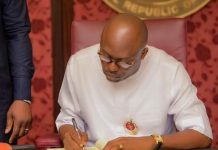

Governor Nyesom Wike of Rivers State has said that he will not allow proceeds from oil companies and businesses operating in the state to be paid to ‘Abuja people.’

He stated this during a stakeholder meeting with representatives of the oil companies on Wednesday.

The governor warned oil companies and business owners not to remit their Value Added Taxes (VAT) to anywhere else but the state.

He vowed to seal off any company undermining the state’s 2021 VAT law.

The governor insisted on stopping the Federal Government from collecting VAT in the state regardless of the consequences.

“I don’t want you to fall prey to the people who think they can use force to take our money. If you want to take advantage and say you don’t know who to pay to, it is a lie, you know,” he said.

“People say that let heaven not fall, but sometimes I believe that heaven should come down so that everybody will rest When we do the right thing, heaven is at peace. So, the right thing must be done at all times.

“I don’t want to be in the good books of anybody but in the good books of God.”

He said the state was ready to challenge the move by the Federal Government to lobby the National Assembly to add VAT to the Exclusive List.

He said the state was collecting only VAT because the law empowered it to do so, and he would not tolerate any attempt by the Federal Inland Revenue Service (FIRS) to undermine it.

He threatened to shut down offices belonging to the FIRS across the state if it continued to bully Rivers.

“You don’t bully states like us. FIRS should be very careful. I have the political will to do a lot of things. If they continue to bully us, I will take all their offices in the state.”

“I will shut FIRS offices in Rivers if bullying continues,” he added.

Wike lamented that his state generated N15 billion in June 2021 but only got N4.7 billion, while Kano, which produced N2.8 billion in June, got N2.8 billion.

A Port Harcourt Federal High Court had, in its judgment last month, in a suit marked FHC/PH/CS/149/2020, held that the Rivers State government had the powers to collect VAT within its territory.

On Monday, a stay of execution filed by the FIRS was struck out by the court.

FIRS had approached the court seeking a stay of execution on the earlier judgment of the court that stopped FIRS from collecting VAT.

The Presiding Judge Stephen Pam said granting the application would negate the principle of equity. He noted that inasmuch as the state government and the state legislature had enacted a law in respect of the VAT, courts were bound to obey the laws.

He noted that the state government and the state house of assembly had duly enacted Rivers State Value Added Tax No. 4, 2021, making it a legitimate right of the state to collect VAT.

The judge said the law remained valid until it was set aside by a court of competent jurisdiction, adding that the law enacted by the state legislature remained valid.